E-commerce drives China's stay-at-home economy in coronavirus aftermath

The new coronavirus outbreak has significantly changed consumer behavior in China and could intensify the rivalry between Alibaba Group Holding Ltd. and Tencent Holdings Ltd. in the low-priced online grocery segment, but the broader outlook for the year remains grim as customers shun high-priced discretionary goods.

As the country shifted to what has been dubbed a stay-at-home economy, consumers ordered fewer restaurant takeouts and cooked more, bought more home cleaning and personal hygiene products, and ordered fewer fashion and discretionary items, according to an analysis of data released by the Chinese government and e-commerce companies. Sales of items such as yoga mats, pajamas and kitchen utensils also surged.

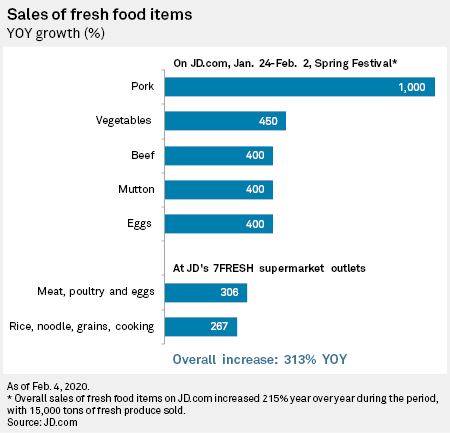

Alibaba and Tencent-backed JD.com Inc. reported that online sales of grocery, fresh produce and consumer essentials grew manifold during the quarantine, driving up the country's online retail sales of physical goods by 3% to 1.123 trillion yuan in the first two months of the year.

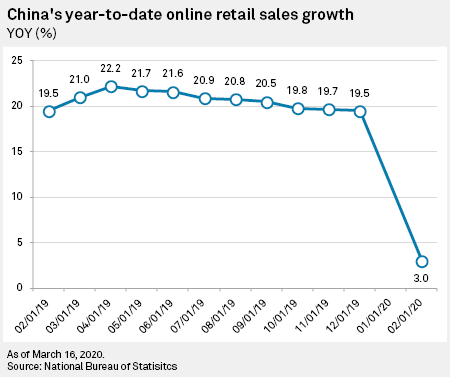

While the growth in online sales was significantly slower compared to a 19.5% rise in the year-ago period and an overall 20% increase in 2019, analysts said it was better than expected as overall retail sales plunged 20.5% year over year during the two-month period.

The slower year-over-year sales growth was a result of low demand for high-valued discretionary items as consumer spending focused largely on cheaper groceries and essential goods. china ecommerce market

Grocery wars

China's online grocery market is now expected to grow 62.9% in 2020 to 264 billion yuan compared to a 29.2% growth in 2019, iiMedia Research reported March 17.

During the first two months of 2020, online sales of food items increased 26.4% compared to 20.2% in the same period a year ago. Essential goods was another category that saw a significant growth at 7.5% during the period, but it was lower than 20.8% in 2019. Apparel sales fell 18.1%, compared to a 15.6% increase a year ago.

Alibaba and rival JD.com, which have invested heavily in online groceries and cold chain supply, are best placed to take advantage of the shift in shopping behavior and are expected to battle for dominance in the online grocery space.

Alibaba's Hema and JD.com's 7Fresh supermarkets offer round-the-clock deliveries for online orders. JD.com backer Tencent also holds stakes in Pinduoduo Inc. and niche online grocery startup MissFresh.

"The last two months of quarantine has reshaped consumers' purchase and transactional behavior to shift more towards online," said William Chuang, Asia equity portfolio manager at AXA Investment Managers. "The biggest winner is likely to be online grocers where consumers can find the cheapest price and convenience."

In contrast, restaurant food delivery services were badly hit due to restaurant closures and safety concerns, said Ming Lu, head of China TMT research at Aequitas Research.

Discretionary goods lose appeal

The surge of online sales in grocery items and fresh produce is unlikely to result in significant gross merchandise value growth for e-commerce companies as these are low-cost items.

"We are still buying things, but many are still spending on lower-priced items," said Shawn Yang, managing director of China-based investment management and advisory firm Blue Lotus Capital.

Analysts said spending on discretionary items such as clothes, cosmetics, skin care and large items like furniture is likely to remain low with weakened consumer sentiment. For example, Chinese consumers washed their hair on fewer occasions during the periods when they were not allowed to leave their homes, according to a report by Kantar Worldpanel.

Yang cautioned that retailers who are not able to clear their inventory for these categories may have to slash prices, which would in turn lead to lower income for the large e-commerce companies.

Alibaba, JD.com and Pinduoduo have pledged to waive commission rates and subsidize deliveries to help merchants overcome financial difficulties during the outbreak, which is likely to hit revenue. Platforms like Alibaba's Taobao, which relies on advertising revenue instead of transaction fees, are also expected to be hit by low ad spend as the economy slows.

"As long as they want to support these merchants, the e-commerce companies will have to wait until COVID-19 is over to be back to normal," said Morningstar analyst Chelsey Tam.

Several Chinese e-commerce players have already issued cautious outlooks for the current quarter, and Chuang believes that the domestic recovery could be at risk this year.

The silver lining

International Women's Day campaigns by Alibaba's TMall and JD.com revealed that there is some pent-up demand for discretionary items.

JD.com said sales of cosmetics and skin care items increased 97% year over year on March 8, with SK-II, Lancôme, L'Oréal SA, Olay and Pechoin the five best-performing brands. The event was the first major online shopping festival since the coronavirus outbreak.

"Soaring sales of lipsticks, aided by livestreaming, indicate that consumers' willingness to spend is high. There is definitely a pent-up demand," said Tam.

Industry observers said platforms like Alibaba and JD.com with robust delivery capabilities will stand to benefit in the coming months.

JD.com, which owns its inventory and has an established logistics network, is expected to pose a far stronger challenge to Alibaba than Pinduoduo, a relatively new entrant with lower stock of necessity items and poorer logistics services, analysts said.

"When you start to worry about inconsistent supply, orders that have not arrived, whether domestic or international, that's another motivation to stick to the big guys," said Jerry Clode, founder of Shanghai-based digital consultancy The Solution. "It's a fundamental shift in mindset for the immediate period."